In marketing, metrics are everything.

Keeping close tabs on key metrics can help you scale with confidence and gain a better understanding of how much to invest in your marketing.

In my latest video and article, I’m covering the five most overlooked metrics, and why they’re so critical to your campaigns.

What You’ll Learn:

- Why metrics matter

- Average purchase value

- Average purchase rate frequency

- Customer value

- Average customer lifespan

- Customer lifetime value

Why the Right Metrics Make a Difference

To propel their business forward, marketers need to do quite a bit of measuring. But not everyone measures the right data.

Simply knowing your page views, click-through rates, and engagement statistics isn’t enough anymore. Many of these isolated data points can’t give you a clear idea of whether you’re getting a good ROI from your marketing spend.

Don’t get us wrong—marketing KPIs can significantly help steer your marketing in the right direction. Still, marketing functions have fallen short when trying to develop a set of marketing indicators that matter.

After all, marketers are constantly in a rotating cycle of flux. And with the ever-increasing number of marketing options and strategies, businesses need to stay ahead of their competition. To help devise an effective strategy, you must hone these critical metrics and their formulas.

You need metrics that tell your company’s story and give you a more detailed snapshot of your marketing efforts. The reality is that you can’t be a successful marketer if you don’t know your numbers.

And, you can’t know your numbers if you don’t understand your customer lifetime value, because it informs your entire marketing strategy and how much you can pay per channel in acquisitions.

In this post, we’ll be covering the top five most important marketing and financial metrics (that you most likely aren’t tracking) that will make you a better marketer and a better businessperson.

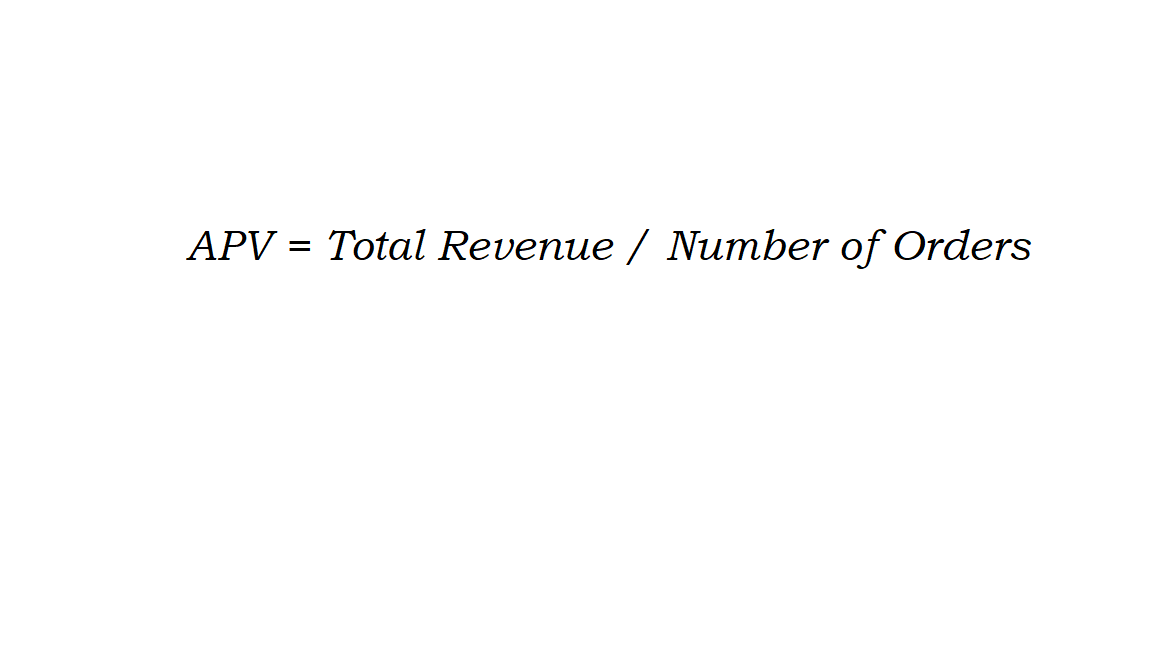

Average Purchase Value (APV)

APV refers to the average sales value of each processed sales transaction. It shows you the average amount of what your customers currently spend on one of your products or services in an individual transaction.

You can calculate this number by dividing your company’s total revenue within a certain time frame by the number of orders made over that same time period.

Depending on the duration of your average contract or your business model, you can calculate the APV for a day, a week, a month, or a year.

Why is APV Important?

First, this metric provides you with essential information about the average first-time order of one of your new customers, which means you can measure if and when this metric increased, and, therefore, identify which offer persuaded them to buy from you.

Furthermore, whether you sell a product or service, you need to factor in the expected pressures associated with competitive pricing. Inevitably, your product will have to compete with others in the market based largely on price.

The APV will allow you to see if this pressure helps or hinders your business. That will enable you to predict and map out your pricing scheme.

With this metric, you and your team can forecast the future of your company’s sales and come up with revenue predictions, as well.

A thorough analysis of the APV will uncover the purchasing behavior of your consumers. You can use that information to inform your ad spend strategy and pinpoint exactly what product or service you should be marketing in the future, as well as how much you should spend on it.

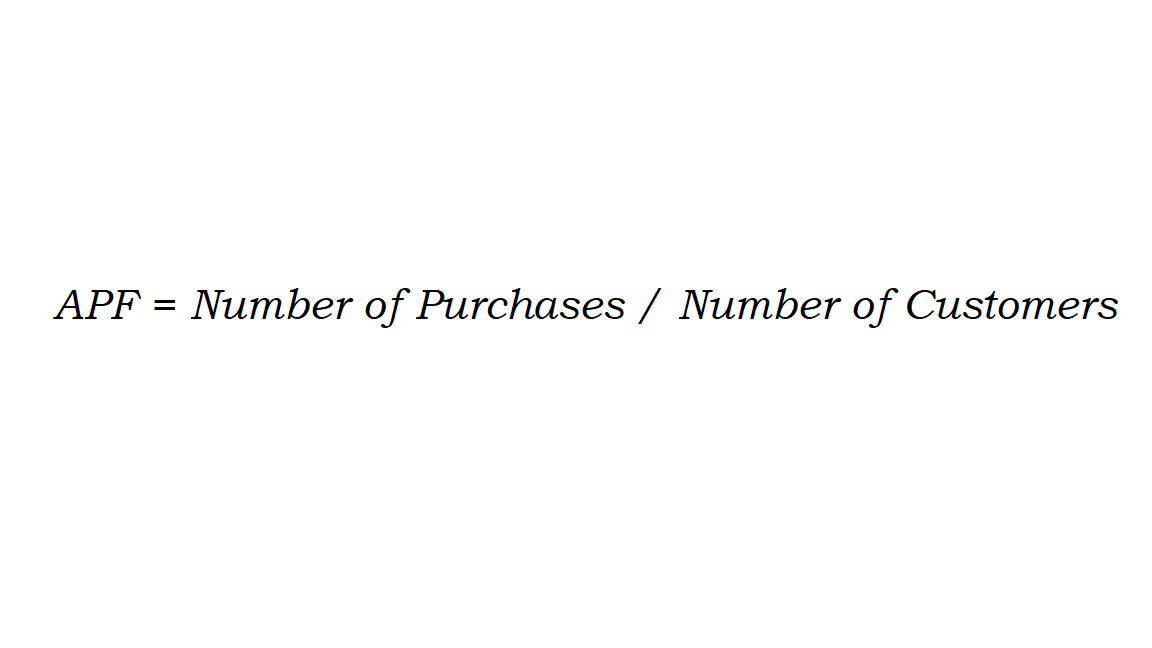

Average Purchase Rate Frequency (APF)

The APF formula is simple: take the number of purchases by a group of unique customers within a given time frame and divide it by the number of customers you have.

Once you perform this function, you can start collecting data to find out whether your shoppers can complete their purchases at a certain time, and when the most profitable buying activities are taking place.

Why is APF Important?

Knowing your APF is extremely useful, particularly when it comes to timing your outreach efforts.

It not only delivers invaluable insight into what value your most profitable customers expect for their money, but you can drill down your findings to a number when looking at the data and determine if they’re over or under your expected profit.

For instance, if your average customer makes three or four purchases within a six-month period, you can then verify that you need to raise that number to five or ten to boost sales.

From there, you can work on improving your purchase rate, as well as target potential customers who have a higher chance of surpassing the average purchase rates.

Then, you can use these figures to launch captivating marketing campaigns and refine your outreach strategies. By integrating this key metric, you can enhance the performance of your business without investing too much money, time, or effort.

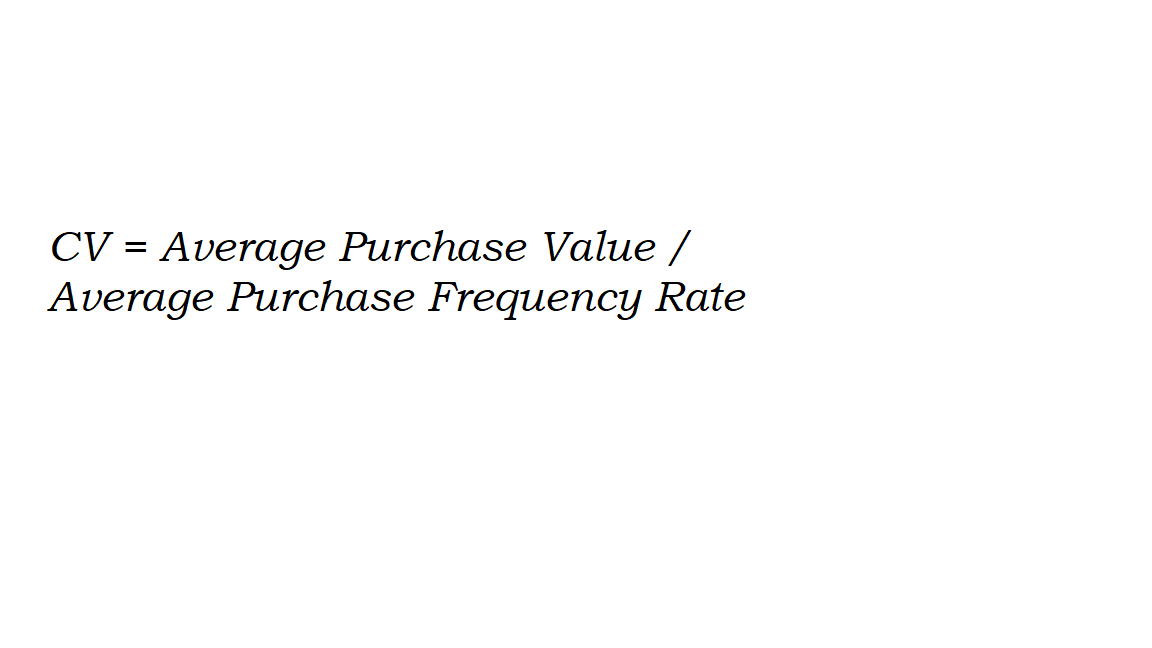

Customer Value (CV)

The CV refers to the economic value a customer brings to your business. The metric considers everything from the initial interaction to their final purchase with your company.

The CV is calculated by dividing the average amount a customer spends on your product or service by how often they’re making those purchases. You can use this formula to estimate how much money the average customer spends and determine the likelihood of their repeat business over time.

Why is CV Important?

A business that is off-balance in terms of customer value produces too little margin, and ultimately ends up operating at a loss.

With the CV, you get a sneak-peek into how well your company is doing and what your expectations should be for the future. This metric allows you to assess your company’s success based on the long-term results of your marketing and advertising strategies.

Finding your CV is crucial to understanding whether there needs to be more value in your marketing channels. In other words, if your CV is higher from a specific marketing channel, you will advocate investing more into retaining customers, presuming that you have a positive ROI.

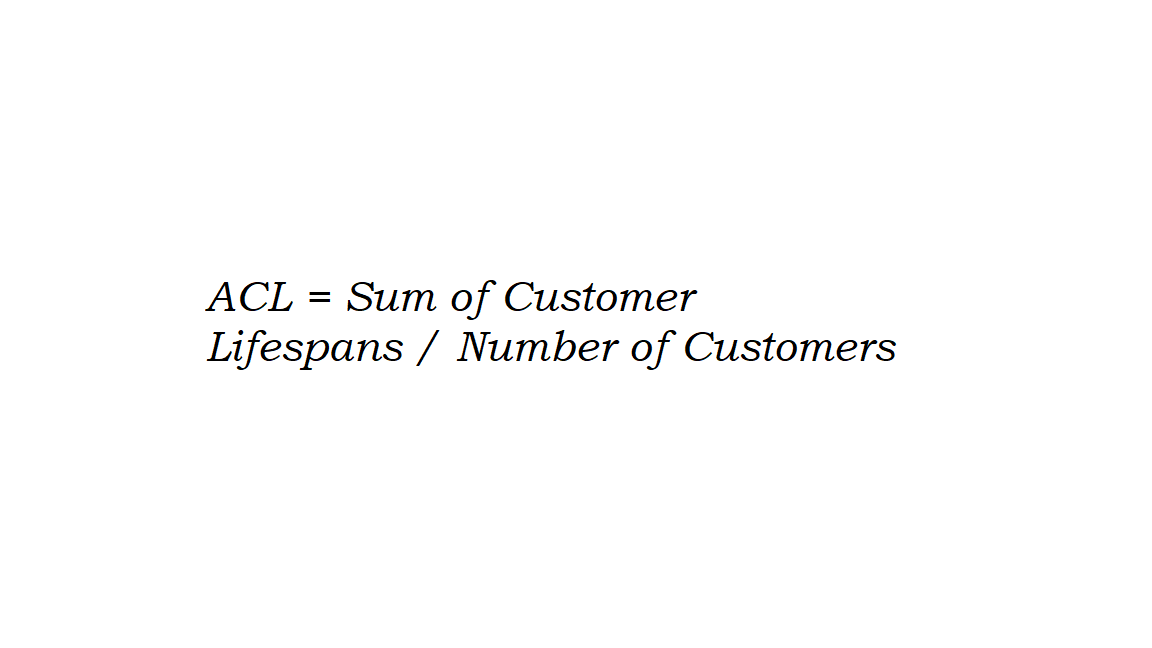

Average Customer Lifespan (ACL)

As one of the last pieces of the puzzle, the ACL tells you the average amount of time that an individual remains a customer. This is a somewhat complicated concept to understand, since it depends on the type of activities you occupy.

To find the ACL, simply add up all of the customer lifespan numbers and divide by the total number of customers you have.

Typically, the ACL ranges between one and three years. However, this metric will change according to your business model.

If your ACL is five months, try to set a new benchmark and learn how to extend it to seven months. If it’s two years, extend it to three years.

Why is ACL Important?

It’s vital for marketers to understand the relationship between the duration of the company-customer relationship and the specific actions that can improve retention rates and profitability.

By looking at these indicators as a marketer, you’ll be able to ascertain if the pulse of the business is moving in the right direction.

Customer lifetime value (CLV)

This piece of data is perhaps the most important metric for many marketers.

CLV measures how valuable a customer is to your business over their lifetime, as opposed to just their first purchase. To find out the CLV, simply multiply the CV by the ACL.

By taking costs and subtracting by that customer value, you can understand what the net income level is within any individual business model. This is the money that comes off the top in relation to any given customer within the particular business model that you’re running.

The reason for this is that there are advertising and marketing costs, general overhead, and various other types of expenditures associated with running a business. But you can’t understand the gross revenue from the ad campaign if you’re assigning an arbitrary number to it. If you can put a real figure on this, it becomes much easier to project and plan for your future growth.

Another important metric to be aware of when determining the CLV is the Return On Advertising Spend (ROAS).

In its simplest definitions, ROAS describes the profit made through advertising. It measures dollars earned versus dollars spent on an ad campaign. Marketers solve the ROAS equation by dividing ad-driven profits by the dollar amount spent on that advertisement.

For example, if you find that your average ad spend is $10 and multiply that by 100, your ROAS is $1,000.

Why is CLV Important?

A 2018 study revealed that only 24% of marketers thought their company monitored CLV effectively.

CLV is key to understand to make crucial business decisions. With this metric, you’ll be able to determine the overall worth of your company’s customers throughout your relationship, as well as get a better idea of your cost per acquisition.

In defining CLV, you can identify how to retain existing customers and allocate funds more effectively, as you won’t have to spend more on marketing and advertising trying to acquire new customers.

Accurate CLV calculations can offer key insights into segmentation, long-term customer profiles, ad performance, and future growth potential for your company.

By better understanding CLV, you can also obtain an accurate calculation of what it costs you to acquire each customer and how to maximize the value of your existing customers.

High CLV also boosts brand loyalty throughout your company’s lifetime.

The Bottom Line

Metrics make the marketing world go round, and there are seemingly endless analytic measurements to look at outside of the ones we listed above.

While it’s helpful to learn by example, remember that no two companies are the same. You should adjust your marketing strategy around the metrics that are most important to you and answer questions that are essential to your business.

Since today’s customers want their interactions with brands to feel like they’re one-on-one, it’s difficult to know whether you’re delivering on those expectations if you’re not measuring the right metrics.

That said, APV, APF, CV, ACL, CLV are tried and true, yet often overlooked, data points that will undoubtedly benefit your business. They can help make your goals real and concrete and make your efforts to reach them visible and quantifiable.

With these metrics in your marketing toolbox, you’re ready to refine your systems, grow your business, and take on even the most ambitious digital marketing goals.